An Old School Banking Tool That Can Be Useful Today

By Amy Persyn

By Amy Persyn

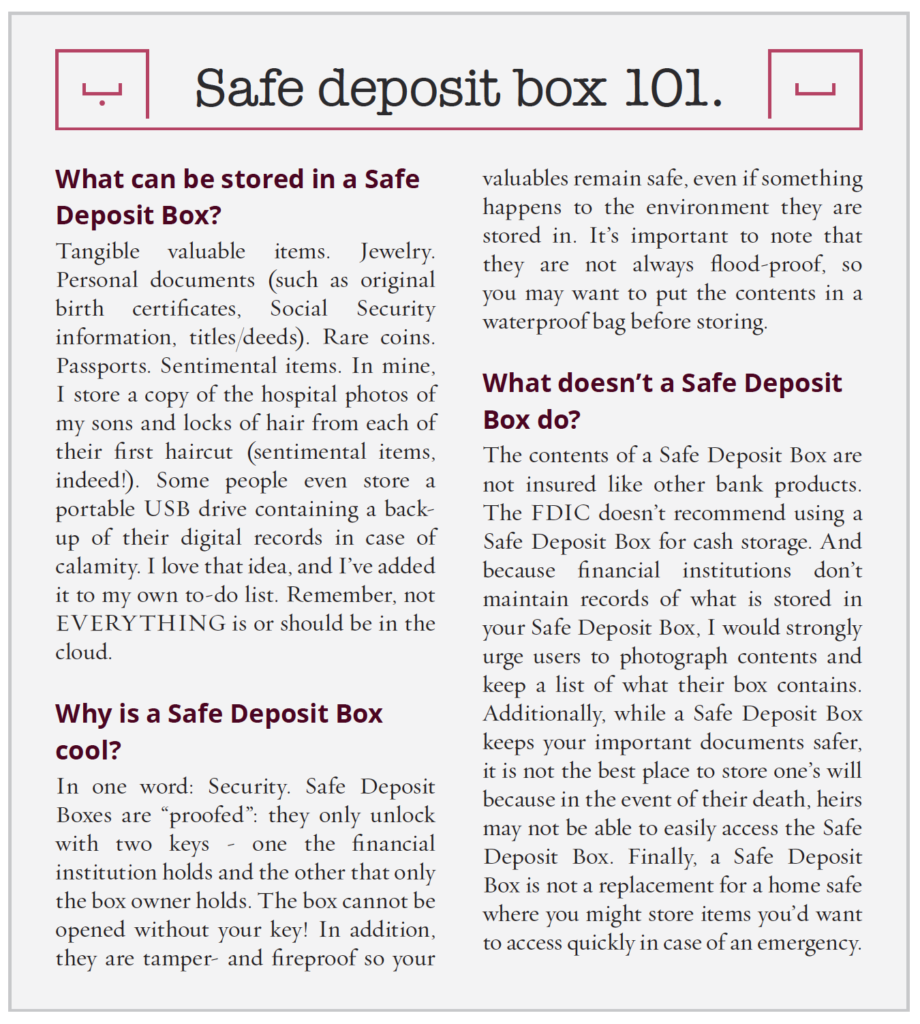

Not that long ago, most of our individual banking needs were met within four walls by people in suits. Now, however, just pull out any smartphone or tablet and chances are that you can transact, make payments, and even get the latest advice about meeting your financial needs. There are so many newfangled ways to manage and protect your assets (most of which I advocate using!), but some services will never translate in a mobile environment. Rusty Old Box or Treasure Trove? I began my career at a local community bank and boy, was it different than today. The accounts came with passbooks and the teller lines were roped with velvet. As I toured my first branch, my tour took me past what looked like miles and miles of Safe Deposit Boxes: heavy steel boxes, in many sizes with multiple keyholes. Outside the box storage area were private booths that people could use to place or remove the contents of their rented boxes. My first thought was, How strange… And if you’ve never had a Safe Deposit Box, or seen one, perhaps you might think so, too. Safe Deposit Boxes are still offered by many financial institutions and the cost of having one is nominal. According to a national survey by Value Penguin, rental fees for Safe Deposit Boxes range from $60–173 annually, depending on box size, however, when it comes to securing valuable items, paperwork, and coins – they can be priceless. In the case of a fire, flood, or burglary, a Safe Deposit Box can ensure your valuables are spared. In fact, FEMA mentions a Safe Deposit Box as a viable option for storing valuable and critical documents as part of a proper emergency preparedness plan. You can see their entire list of recommendations at fema.gov.

In a world full of technological advances, when it comes to financial preparedness, there’s still a place for the classics.

Amy Persyn is a lifelong Macomb County Resident. She is passionate about connecting families and entrepreneurs with information that can help them become empowered and financially literate. New to First State Bank, Amy is happy to be part of a team of people who “walk-the-walk” and do their part to make our community great!

Amy Persyn is a lifelong Macomb County Resident. She is passionate about connecting families and entrepreneurs with information that can help them become empowered and financially literate. New to First State Bank, Amy is happy to be part of a team of people who “walk-the-walk” and do their part to make our community great!